How Does Currency Strength Indicator Look Like?

Introduction to Currency Strength Meter

On a broader scale a strong currency for a long period of time could lead to businesses moving overseas to lower the price of their goods and services to other countries. Currency Strength Indicator shows you in a simple and quick way, when a currency is oversold, overbought or in "normal area". MT4 Currency Strength Meter indicator uses a unique algorithm to establish the absolute strength of a currency. the relative purchasing power for goods and services in comparison to foreign currencies the relevance as a financial valuation and exchange device in foreign economies the acceptability in international trade, driving foreign central banks to hold reserves As the local production activities add further value to the country's economy, higher encourages spending.

To move from one tab to another simply left click on the grey tab to select the appropriate window. In order for this indicator to bring you your desired outcome, it is vital that you pair your trading with Forex strength meter with other indicators and chart analysis. There are a range of advantages to using a currency correlation matrix as a Forex strength indicator, including its simplicity, it's usefulness as a short-term indicator, the ability to eliminate double exposure and unnecessary hedging, the ability to signal high-risk trades, and the fact that it's available for free. This indicator helps traders see which trading pairs are the strongest and which are the weakest on different time scales. If the market is currently correcting from a massive spike not too long ago there is no Forex strength meter guide that could help traders navigate through the volatility.

With this information traders will have a great advantage on their operations. For example, a country that adopts export-led growth, like China, would prefer a low currency strength to maintain the cost-effectiveness of the locally produced goods and services and to continue attracting foreign buyers. In this video we introduce some of the basic concepts of the Quantum Trading currency strength indicator, how it works, how to use it, and how to identify low risk trading opportunities. For example, if the EURGBP and GBPUSD have a correlation of -91, this means they have a negative correlation - these pairs are likely to move in opposite directions, so two long trades (or two short trades) on these pairs would likely cancel each other out. 15.04.2019 * reading time: 10min

If you want to learn how to find the strongest and weakest currency to trade, lay your hands on the Currency Strength Indicator Thank you for reading! look for a strong trend in one currency; and observe most of the forex market in one chart. Before we start explaining how the currency strength meter (CSM) works, let's try to explain what is a currency strength meter in the context of Forex trading . In the second part of the forex trading session at the London open, David explains how to use the currency strength indicator to identify trends and focuses on the GBP/USD which develops into an excellent trend lower on the faster timeframes.

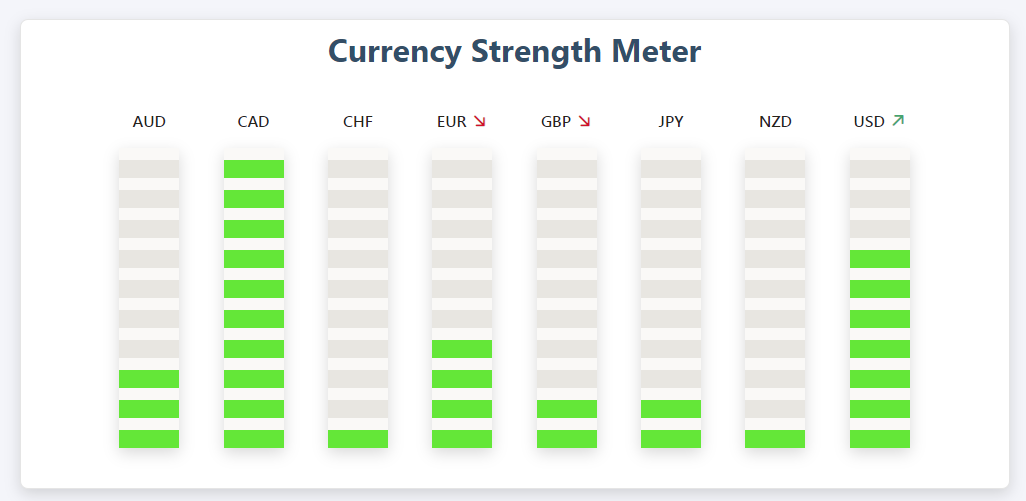

Additionally, forex traders can wait until one currency shows an extreme strength reading and another currency shows extreme weakness reading and try to trade a reversal. Our currency strength meter gives you a quick visual guide to which currencies are currently strong, and which ones are weak. Currency strength is calculated from the U.S. Dollar Index , which is used as a reference for other currency indexes. With a Forex correlation matrix, you can see at a glance which currencies are correlated, which means you can avoid making these trades in the first place, and can consequently avoid double exposure to a weak currency. Most traders use the strength meter alongside an existing strategy as a way to trade in the same direction as the underlying strength of the markets.

Using CSM for grid trade

Using multiple timeframes to trade is a powerful approach but one which can also be applied when using the currency strength indicator. Let's say that the USD is rated as a strong currency at this moment, and the EUR is rated as weak. Currency strength matrix is a currency strength meter tool developed to measure the strength of the eight main currencies. The Currency Strength Indicator is fully configurable and designed to optimise Grid trading success. One of the downsides to a strong dollar is that it becomes more expensive for foreign countries to buy products made in the U.S.

On the other hand, countries that aim for import-led growth, like the U.S., care to have strong currency value which would enable them to enjoy a strong purchasing power that enables to import products in large quantities. Usually, a currency strength indicator comprises lines that fluctuate around a horizontal line (zero level). The TSI uses moving averages of the underlying momentum of a financial instrument. You can sort the currencies by strength in a specific timeframe to see the strongest ones on top, and the weakest ones at the bottom. Our currency strength indicator measures strength of eight major currencies (USD, EUR, GBP, CHF, JPY, CAD, AUD, NZD) by using Relative Strength Index indicator, also known as RSI.

Currency strength is calculated from the USDX , which is used as a reference for other currency indexes. The purpose of the currency strength indicator (or a currency strength meter) is to show the strength of the individual currencies in the market in order to understand which of them are the strong (or getting stronger) and which of them are the weak (or getting weaker). In addition, if the U.S. dollar is strong, it can potentially become cheaper for the U.S. to purchase foreign imported goods over domestically produced goods. There are many currency strength indicators available around.

Use our free currency strength meter to identify the strongest currencies in the Forex market. Conversely, a currency is considered "weak" if it is becoming less valuable versus another country's currency. It's at these points that the current trend is likely to reverse, offering you potential low risk trading opportunities as a result. Simple indicator implementing relative strength against the equally weighted basket of major currencies. The basic idea behind indicators is "to buy strong currency and to sell weak currency".

Our proprietary formula to calculate the currency strength works better than all other free currency strength indicators combine together. Currency Strength Indicator – Trend and Swing Trading Examples In the foreign exchange markets, a currency's strength is measured in relation to foreign currencies in the Forex currency pairs. The Quantum currency strength indicator isolates each individual currency from the 28 currency pairs, making it quick and easy to see trading opportunities as currencies move from strong to weak and back again, all the time. Before we reveal our currency strength trading strategy, let's first lay down the foundation.

Conversely, if two currencies are weak, strong or average strength, there is often a range or sideways movement happening. What might also happen is that one of the pairs indicates a strong movement, while the other is just ranging, which signals traders to avoid entering trades with correlated pairs in the opposite direction. Apply everything you've learnt on a real trading account with up to 1:777 leverage, negative balance protection and outstanding support. The currency strength indicator identifies when a currency is strong or weak, oversold or overbought and works on all timeframes from minutes to months. Decreasing borrowing costs accelerates production, and the national Gross Domestic Product (GDP) income and wages of the citizens translate into increased spending and consumer demand, leading to the of consumer prices and allowing the businesses to enjoy higher .

It is very common in this case to use other existing normalized indicators and to combine them together in order to calculate the strength of a specific currency. JPY Relative Strength Comparison to the basket of other major currencies. Sell strong currency and buy weak currency - Counter Trend strategy. If the dollar is strong, then the cost of imported goods such as electronics, cars, and food becomes cheaper. Common indicators usually show the strength of a currency in relation to another currency, however, with some calculations it is possible to find the absolute strength of each individual currency.

Conclusion

Instruments such as the US Dollar Index are weighted indexes which compare the Dollar's value relative to a basket of other currencies (look at XM review for example). Our free currency strength meter is designed to give you a quick overview of the underlying movement of each individual currency in the Forex market.